The container transport rates on road in Benelux and Germany have decreased to a two year low, but still 18% higher than compared to 2020 levels, the year the Covid-19 fueled boom began. The drayage market is following global decreased demand trends without a clear sign to pick up soon. This article delves into all transports executed on the UTURN platform in Netherlands, Belgium and Germany and shares all its pricing secrets.

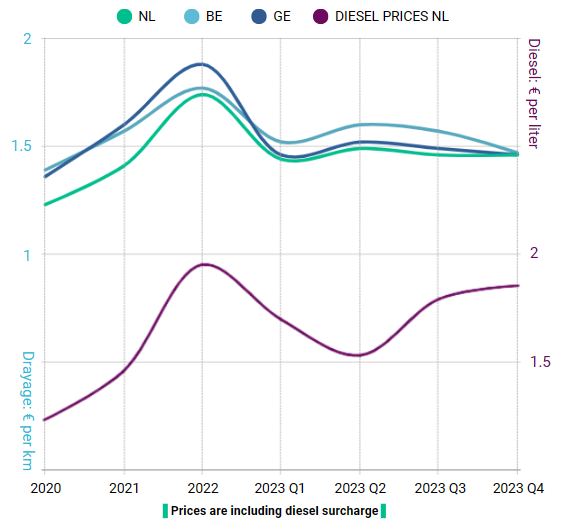

Price trends across countries

The average kilometer price including diesel of export and import shipments have decreased for all countries around the last turn of the year and have normalized around 2021 levels. This is noteworthy considering the increases we have seen of all major cost drivers, including wages, general inflation and diesel prices. Compared to 2021, the diesel price has increased with 18%, while all-in transport prices remained unchanged. Belgium seemed to have experienced a softer drop in 2023, however this seamed to be more effected by increased road taxations for trucks opposed to a higher demand. As per the first of December Germany has introduced the new toll increases, this is expected to increase all-in prices with around 8% towards next year.

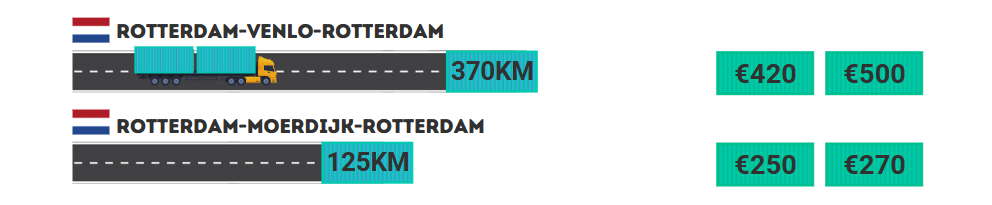

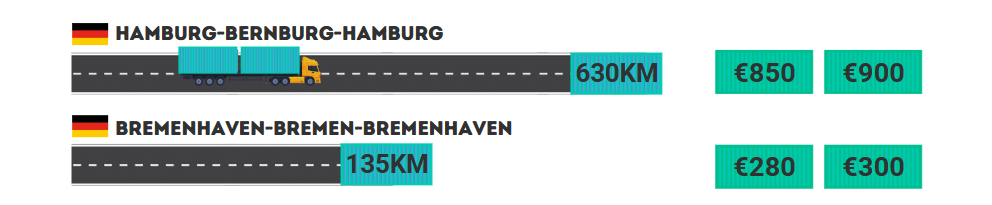

Popular drayage routes

Kilometer prices are perfect to show trends over longer periods however they decrease over longer distances and can be hard to interpret correctly. For this reason we have analyzed lanes that are commonly used. In figure 2 to 4 we show the price range of 50% around the average. This means that 25% of shipments are lower priced than the range and 25% is higher priced then the range. Interested in calculating your own routes? click here to use the UTURN price calculator.

How can you influence price?

Target price

Setting a realistic target price significantly influences the outcome of a shipment. Although it may seem strategic to establish extremely low pricing targets, this often proves counterproductive. The most heard reason from transporters to withdraw from quoting are unrealistic target prices. The price calculator can help with determining the current marketprice. Figure 5 shows the percentage above, under and on target price, The majority of shipments get matched either on or above the target set by the shipper.

Publish and pick-up time

Additionally the lead time between publishing and execution has impact on the price. Figure 6 shows the lead time and corresponding average prices. The message is simple, when you can give a carrier more time in there planning it results in a better price.

Interested to learn more about UTURN? Click here to leave your e-mail.